puerto rico tax incentives act 20

Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed. Act 20 offers a two 2 fixed corporate income tax rate during the first five 5 years and four 4 corporate income tax rate remaining period for PYMES Small Medium Sized businesses providing services for exportation 100 tax-exempt dividends from earnings and profits.

What Logan Paul S Move To Puerto Rico Means Beyond The Tax Breaks

Act 20-2012 promotes the export of services Act 22-2012 encourages relocation of individual investors.

. More importantly the requirements for each program have been adjusted. 20 of 2012 as amended known as the Export Services Act the Act to offer the necessary elements for the creation of a World Class International Service Center. 100 Tax Exemption on Income Tax Rate from dividends or profit distributions.

ACT 20 ACT 22. The Act provides tax exemption to businesses engaged in eligible activities in Puerto Rico. Act 60 of 2019 known as the Puerto Rico Incentives Code was enacted to consolidate into one single act and simplify all incentives available for individuals and businesses in Puerto Rico under the previous incentives laws.

Citizens that become residents of Puerto Rico. In addition the law promotes investments on research and development and initiatives from the academic and private sectors by granting credits and exemptions for these activities. The former Act 20 which focused on businesses established in Puerto Rico that exported their goods or services abroad was split up into two separate acts in the newly enacted Act 60.

Act 20 Puerto Rico Tax Incentives. Spend a minimum of 100000 in payments per project to Puerto Rico Residents including equipment crew travel and accommodations 50000 for short films. Services Hub Trading Act 20.

20 tax credit payments made to Non-Resident Talent are subject to a 20 withholding over their PR income. 60 tax exemption on municipal license taxes. Legislative acts producing tax advantages in Puerto Rico.

4 Fixed Income Tax Rate on Income related to export of services or goods. In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here. In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020.

Now known as Chapter 3 of the Incentives Code Puerto Ricos Act 20 was originally known as the Export Services Act. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investors. 20 of 2012 known as the Act to promote the exportation of services provides attractive tax incentives for companies that establish and expand their export services businesses in the island.

With the Export Trade and Hubs act Puerto Rico incentivizes eligible businesses that derive at least 80 of their gross income from the traffic or export of products. Puerto Rico July 6 2022. On January 17 2012 Puerto Rico enacted Act No.

Many high-net worth Taxpayers are understandably upset about the massive US. 100 Tax exemption on Excise Tax and sales and use tax. Also it aims to convince foreign services providers to move their businesses to Puerto Rico.

What is Puerto Rico Act 20. Act 20 provides tax incentives for companies that establish and expand their export services businesses in Puerto Rico. The first is Puerto Ricos Act 20 known as the Export Services Act available to citizens of any country.

Puerto Rico Corporations who qualify for the Act 20 tax exemptions can cut their corporate tax rate to a mere 4. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. Puerto Rico Incentives Code 60 for prior Acts 2020.

Export Services incentive previously covered under Act 20 of 2012 known as the Act to Promote Export of Services. Puerto Rico has created an aggressive tax incentive program to connect with the global economy in order to establish an ever-growing array of service industries and to establish as an international service and trading hub center. Puerto Rico Tax Haven.

The New Incentives Code allows for the companys operation and service deliverybe performed from and outside Puerto Rico. With the tax incentives overhaul of 2019 a couple of new requirements were added to Act 22 beginning in January of 2020. The legislation allows Puerto Rico to offer qualifying businesses that export services from the island nation the opportunity to cut their corporate tax rate to a mere 4.

As of January 1 2020 Act 20 and 22 have been replaced by Act 60 which brings with it some changes to the requirements. Changes to Act 2022 New Incentives Code of Puerto Rico for Jan 1 2020. Of particular interest are Chapter 2 of Act 60 for Resident Individual Investors and Chapter 3 for Export Services which shield new residents who live in Puerto Rico for at least half the year from paying most federal income taxes.

Sometimes effective tax planning can help avoid these taxes. This is substantial when you consider that if you were running the same LLC from the United States mainland you would be. Find out how your business can benefit from the new tax laws in Puerto Rico.

100 real property taxes. Taxes levied on their employment investment and corporate income. Call us now at 404-445-8095 or request a consultation online.

Act 20 provides an opportunity for firms established in Puerto Rico with local or non-local capital to export services at a preferential tax rate among other benefits. It allows you to slash your corporate tax rate to only 4. Along with the long-standing bona fide residence requirement the Puerto Rico housing incentive act now requires you to now buy a home and make a qualifying donation to a local Puerto Rican charity.

Under Act 20 income from eligible services rendered for the benefit of non-resident individuals or foreign entities Export Services Income or EIS is taxed at a reduced tax rate of 4 percent. 100 Exemption on US Federal Income Tax. Dividends paid to you personally from your Act 20 company also wont be taxed AT ALL but only as long as you are a bona fide resident of Puerto Rico.

DLA Piper - Manuel López-Zambrana Andrés Fortuna-García. Puerto Rico US Tax. If you cant read this PDF you can view its text here.

We have reviewed the language of the new law and are pleased to share the major changes to the Act 20 and 22 program below.

Puerto Rico Tax Incentives Can Puerto Rico Have Nice Things

A Red Card For Puerto Rico Tax Incentives

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Puerto Rico Act 60 Incentives Code Tax Savings Are Pr Acts 20 22 It A Myth Youtube

Puerto Rico S Economic Development Opening With Acts 20 22 And Opportunity Zones Grant Thornton

Overview Relocate And Move To Puerto Rico With Act 20 Act 22

A Tax Haven Called Puerto Rico Eyes On The Ties

The Puerto Rico Tax Haven Will Act 20 Work For You

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

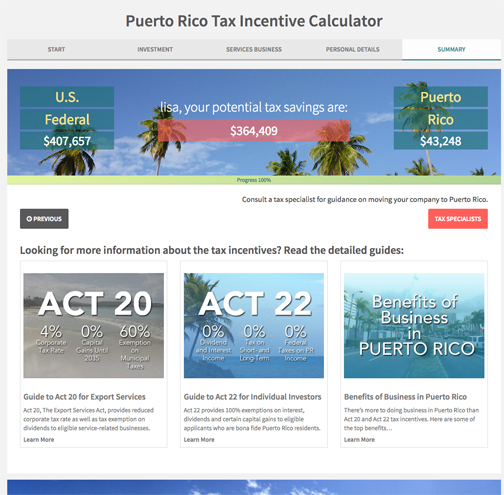

Pr Business Link Launches Tax Incentive Calculator News Is My Business

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Immigrate To Puerto Rico And Apply For Tax Residency Act 20 Act 22 Residencies Io

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Guide To Income Tax In Puerto Rico

Relocate Puerto Rico Puerto Rico Tax Incentives Act 20 Act 22 Residency Facebook By Relocate Puerto Rico Quickly Learn If The Two Most Popular Tax Incentives In

The Impacts Of Puerto Rico S Act 20 And Act 22

A Global Americans Review Of Boom And Bust In Puerto Rico How Politics Destroyed An Economic Miracle

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Changes To Act 20 22 New Incentives Code Of Puerto Rico For Jan 1 2020 Relocate To Puerto Rico With Act 60 20 22